Partnership spotlight: Faraday joins the Standard Information App Marketplace

Faraday now delivers real-time “Likely finance decline” enrichment in Standard Information’s App Marketplace, helping teams filter and route leads earlier to avoid dead-end financing outcomes.

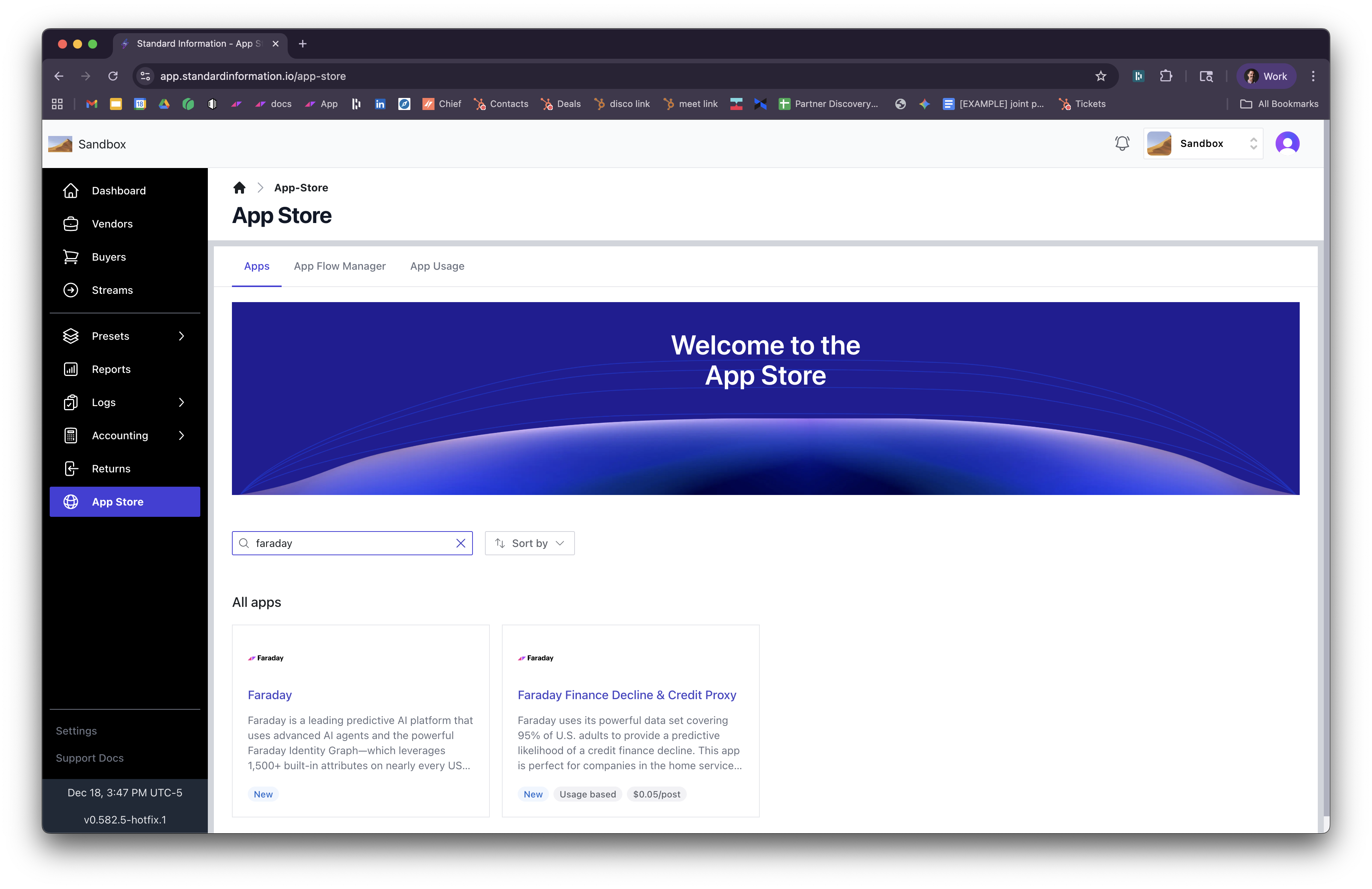

Faraday has officially expanded our partnership with Standard Information to bring our predictive lead enrichment directly into their App Marketplace. For Standard Information’s customers, this means integrating Faraday’s consumer data into your lead-buying workflow has never been easier!

And because we’re all about targeting and personalization, we didn’t want to just “drop data” into a marketplace and call it a day. Instead, we wanted to deliver Faraday’s insights in a way that was specifically tailored to the business needs and challenges Standard Information customers actually experience: high appointment volume that doesn’t translate into revenue because too many deals stall at the financing step.

Our new “Likely finance decline,” workflow powered by Credit Score Proxy

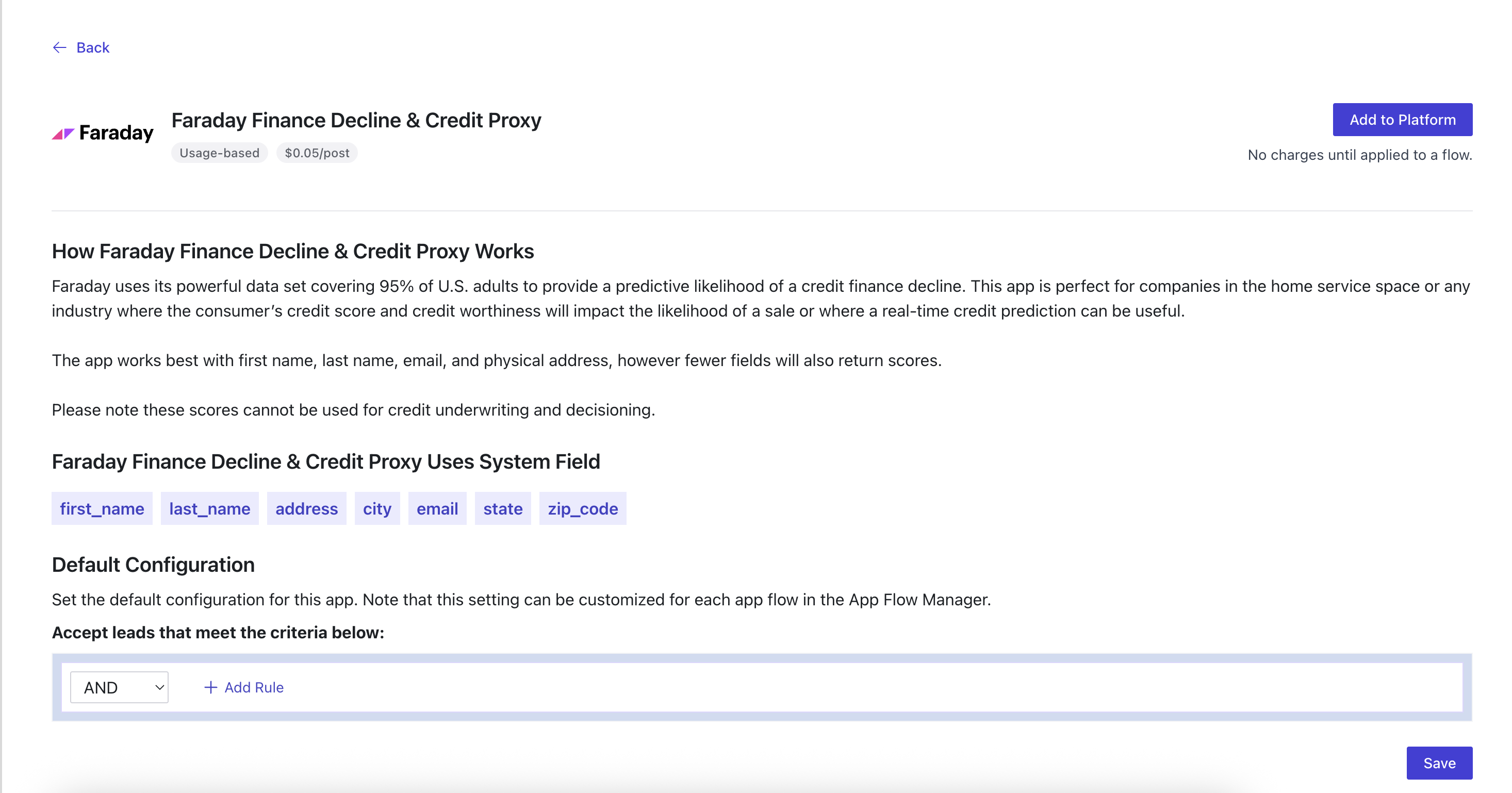

To accomplish this goal, we took a Faraday datapoint we already know drives meaningful value, Credit Score Proxy, and deployed it inside a workflow Standard Information customers care about: identifying whether a lead is likely to stall out at the financing stage later in the funnel.

In high-volume sales environments, speed is everything. But speed doesn’t matter if your team is sprinting toward a dead end, specifically a financial decline. Every lead that makes it to a sales rep (or an appointment) only to fail at the financing stage is a wasted investment in time, labor, and acquisition cost.

This “likely finance decline” signal helps teams make better decisions earlier, and personalize what happens next.

How this workflow drives value for your business

- Filter before buying: Because this data is available in real-time, you can reject unlikely-to-qualify leads before you ever pay to add them to your CRM, saving your budget for high-potential prospects.

- Optimize sales routing: Don’t think of this datapoint as a simple “lead blocker” that just rejects leads. It can also be used for numerous downfunnel applications like lead routing.

- Built for speed and scale: Because workflow is built on a pre-modeled datapoint (Credit Score Proxy), it’s available on Day 1 for any individual recognized in our Faraday Identity Graph. Paired with competitive pricing (at $0.05 per append), this means you can bypass the usual custom data science lead times and pricing to immediately deploy this datapoint across 100% of your lead volume for rapid ROI.

We’re just getting started

At Faraday, we don’t believe in “data for data’s sake.” Brands don’t just need more data, they need the right datapoints applied in the right workflows to drive action.

That’s why we started with this targeted workflow, but we’re just getting started. Our goal in all aspects of our business is to give customers a 360-degree view of every prospect and client, and we’ve already got ideas for what we can bring to Standard Information’s unique customers next. So keep an eye out!

And if you're ready to stop chasing dead-end leads, give our friends at Standard Information a shout and find Faraday’s enrichment in their App Marketplace!

David Small

As Head of Sales & Partnerships, Dave develops and executes strategies that emphasize mutual growth for Faraday’s partner ecosystem. He works closely with Faraday’s executive team on finding, developing, and growing new relationships across technology companies, lead generators, and agencies. Dave has spent his career in client facing roles, supporting the rollout of emerging technologies and high-impact marketing campaigns. He earned a BA in Sociology from Middlebury College and is based in Vergennes, Vermont.

Ben Rose

Ben Rose is a Growth Marketing Manager at Faraday, where he focuses on turning the company’s work with data and consumer behavior into clear stories and the systems that support them at scale. With a diverse background ranging from Theatrical and Architectural design to Art Direction, Ben brings a unique "design-thinking" approach to growth marketing. When he isn’t optimizing workflows or writing content, he’s likely composing electronic music or hiking in the back country.

Ready for easy AI?

Skip the ML struggle and focus on your downstream application. We have built-in demographic data so you can get started with just your PII.