When every call is intentional, context matters more than ever: Progressive dialing makes smarter filters critical for your call center

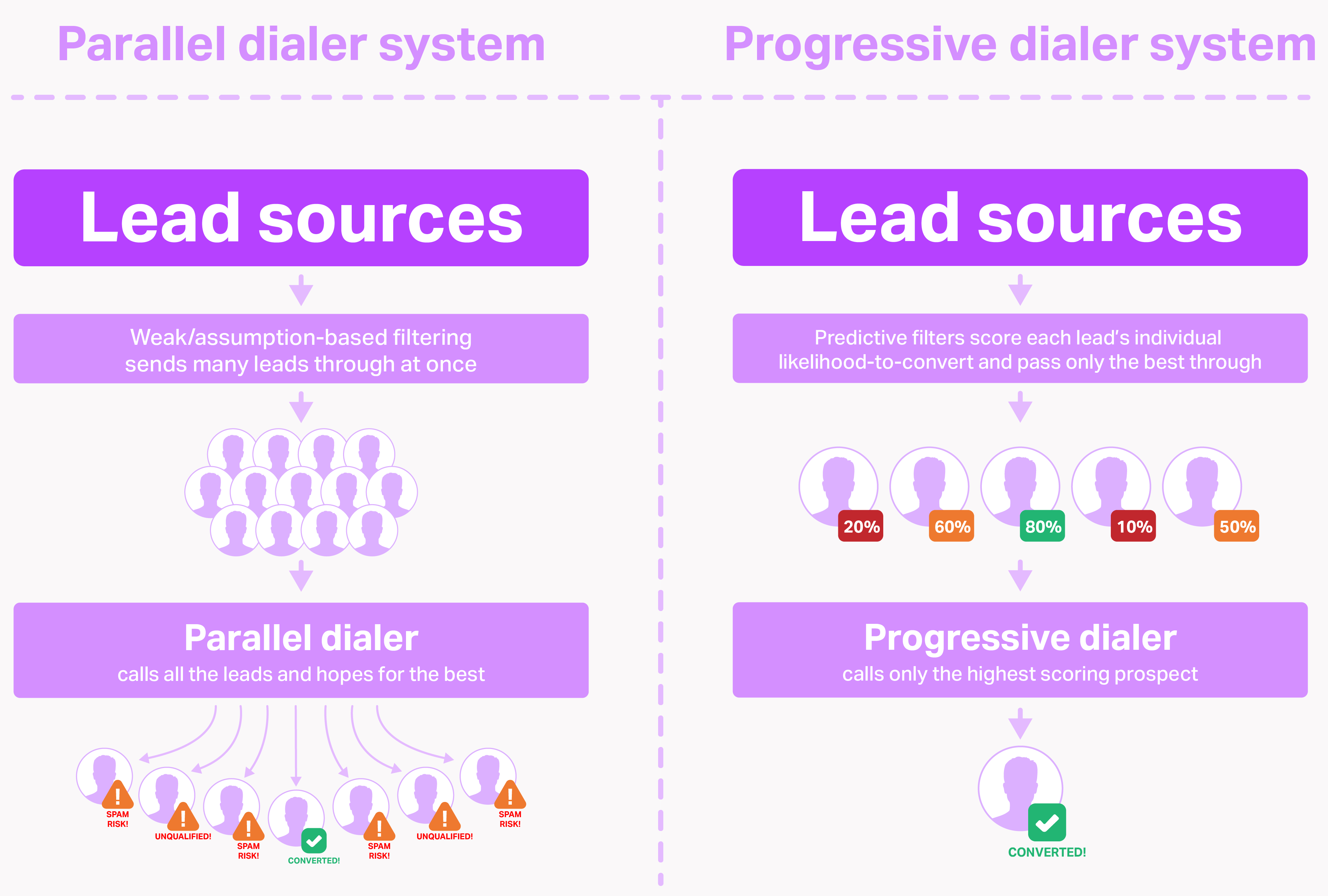

As parallel dialing collapses under compliance pressure, teams win by pairing progressive dialing with smarter, outcome-driven filtration that prioritizes the right prospects at every step.

For insurance and debt-resolution teams, the high-volume, parallel-dialing era is breaking under modern spam protections and compliance pressure. The old assumption that maximizing dials will eventually produce results is no longer reliable.

Parallel dialing, which made it easy to brute-force a list by firing multiple calls at once, is now a liability. Carrier spam systems are stricter, VoIP behavior is aggressively penalized, and consumers block unknown numbers faster than ever. The harder you dial, the faster your numbers get flagged as “Scam Likely.”

Because of this, many organizations are shifting toward progressive dialing, a system where Agents work leads one at a time. This reduces abandoned calls and keeps compliance risk in check. That does not mean high-volume or parallel strategies never make sense. It does mean that, for most day-to-day calling, more intentional, progressive behavior is becoming the norm. But this shift introduces a new requirement: if each call is deliberate, every prospect needs a real chance of converting.

The thing is that progressive dialing doesn’t fix weak filtering; in fact, it makes those weaknesses impossible to ignore. The raw volume safety net is gone. Once volume goes away, the quality of your scoring becomes the deciding factor in whether your call center generates value or falls flat.

Fewer dials, higher stakes

Parallel dialing allowed teams to get results even with imprecise filtering, as the sheer volume of attempts eventually surfaced the best leads anyway. Progressive dialing changes that dynamic. When agents call leads one at a time, each conversation carries more value. Time spent on a poor-fit record is time not spent on a viable customer and this shift exposes a structural weakness in most systems:

The filtering logic in front of the dialer was built for a world where volume covers for imprecision.

In most organizations, existing filters rely on outdated assumptions, demographic shortcuts, and scoring models that don’t reflect actual conversion outcomes.

This filtration layer often fails because it uses:

- Guesswork filters, like “higher income is better” or “certain ZIPs respond more.”

- Manual rules added years ago that rarely get revisited.

- Lead scores that rely only on demographic data alone without factoring in conversion outcomes.

- A disconnect between real-time conversion data and day-to-day prioritization.

Under parallel dialing, this was “good enough” but with progressive dialing, that safety net disappears.

If your system can’t surface your most viable prospects early, agents waste their best hours and expensive leads get burned without meaningful lift.

What better filtration looks like

So you might find yourself asking: what filters do I actually need for a financial-services call center?

The answer isn’t a single score or one magic rule. It is a handful of signals that give your tools and teams the context they need to decide which prospects are worth prioritizing, which deserve immediate outreach, and which should take a different path entirely.

Better filtration in insurance and debt-resolution usually comes down to a few core areas:

- Quality at the moment of purchase: Teams need a way to understand which leads are likely to engage or advance, and which should be down-bid or skipped altogether. This decision happens before anyone makes a call, and it depends entirely on having meaningful context at the point of purchase.

- Early engagement signals: A significant amount of agent time is lost on people who are not in a position to meaningfully engage. Early behavioral or modeled signals, whether from form data or enrichment, give teams the context they need to focus agents on prospects who are more prepared for a productive conversation.

- Likelihood to convert: Once a lead is in your system, the order you work it in matters. Teams rely on predictive context to decide which records to prioritize during peak windows so the highest-value prospects get attention when it is most likely to count.

- Matching prospects to the right path: Not every lead should go straight to an agent. Context helps teams decide which prospects warrant immediate outreach, which should enter warm-up flows in email or SMS, and which should move into slower, lower-cost nurture until their behavior changes.

(The routing itself happens in the CRM, dialer, or marketing tools. Faraday provides the signals those systems rely on.)

When these decisions line up, the entire funnel tightens. Teams use their resources more effectively, agents spend more time in productive conversations, and performance improves without adding volume. The difference comes from having the right context in place to drive smarter decisions.

Where Faraday fits in

For insurance and debt-resolution teams, Faraday regularly sits at the very top of the funnel. Many teams connect us through LeadConduit where we score inbound leads in real time and help prioritize which records deserve immediate attention. Many also use our credit score proxy at this stage, since it gives an early signal that informs routing decisions and focuses agent time without requiring a hard pull. That alone keeps teams engaging the people who are most likely to respond or stay in the conversation.

Once a lead is accepted, that same score carries downstream into your CRM or dialer. Teams use this context to decide who should be worked first, who should enter warm-up through email or SMS, and who should move into slower, lower-cost nurture until their behavior changes. Faraday provides the intelligence that supports these decisions while the actual routing happens in the tools teams already use.

The impact isn’t just a cleaner scoring step, it’s the continuity it gives the entire funnel. From buying the lead to deciding who should be called next, the same prioritization signal flows through. Teams avoid overspending on records unlikely to engage, agents spend more of their day in meaningful conversations, and the call center starts to feel productive again instead of overloaded.

The bottom line

Parallel dialing lets you get away with weak filters. Progressive dialing won’t.

As the industry standardizes around progressive behavior to stay compliant, filtration becomes the real competitive advantage for most day-to-day calling. There are still situations where higher-volume strategies are appropriate. The point is to match the dialing approach to the job at hand and support both with strong intelligence in front of the dialer.

If your 2026 plan involves dialing fewer people more thoughtfully, the key question isn't which dialer you use. It’s whether the intelligence in front of it is smart enough to make every call slot count.

Robin Spencer

Robin Spencer is Faraday’s COO, leading all of our client-facing teams—from sales to customer success. Her mission is simple: help consumer businesses uncover where data can meaningfully improve (and profitably accelerate) the customer journey. Robin brings experience from Accenture, Google, and Clearbit (acquired by HubSpot), where she focused on using data to drive real, measurable business outcomes. When she’s not geeking out about data and operational strategy, you’ll find her tending her cut-flower garden, knee-deep in a creative project, or wandering in the woods nearby.

Ready for easy AI?

Skip the ML struggle and focus on your downstream application. We have built-in demographic data so you can get started with just your PII.