The unexpected data that powers smarter predictions

Faraday's Identity Graph (FIG) includes unexpected customer traits—like "roof type" or "interest in boating"—and detects patterns amongst them that humans might miss, helping businesses make smarter, data-driven decisions.

This post is part of a series called Faraday Identity Graph that helps Faraday users understand how FIG works, and how they can use it to generate value for their business

You know your customers—but do you know how to quantify them? Have you ever considered that something as seemingly random as "roof type" or "interest in boating" might influence whether someone wants to buy your product? The reality is, we’re all made up of a range of datapoints, and we don’t always know which ones will most impact purchasing behaviors.

That’s why the Faraday Identity Graph, a gigantic set of 1,500+ customer attributes is so valuable. It captures both the obvious and the unexpected, giving businesses an edge in understanding what truly drives conversions. Still not convinced? Let’s take a look at some of the weirdest, most surprising datapoints that can help businesses make smarter decisions.

Now, please note that these are hypothetical examples—after all, we wouldn’t want to disclose any of our current customers’ “secret sauce.” However, these vignettes illustrate the unexpected ways our FIG has informed value-driving outcomes.

Vignettes: expected problems with unexpected solutions

Predicting insurance customers who need premium coverage

-

Challenge: An insurance provider wants to upsell premium policies to the right customers but relying solely on income data hasn't been cutting it.

-

Unexpected solution: "Spending habits percentile" — Individuals who consistently spend at higher levels tend to value protection for their assets and financial well-being. By identifying high-spending individuals, the insurer can target them with personalized offers for premium life, home, and auto insurance policies, ensuring they have the right coverage for their lifestyle.

Finding the best locations for a new coffee chain

-

Challenge: A growing coffee brand needs to find locations with high morning foot traffic.

-

Unexpected solution: "Propensity to own a dog" — Dog owners tend to follow a routine and take their pets for walks in the morning, making them prime candidates for coffee shop visits. By targeting neighborhoods with a high concentration of dog owners, the coffee brand can identify areas with a ready customer base for morning foot traffic.

Predicting high-end jewelry buyers

-

Challenge: A trendy jeweler is aiming to branch into new markets. They know some indicators like income level and location are relevant, but what else might help?

-

Unexpected solution: "Garage parking spaces" — People who have garage parking are often homeowners with higher incomes, typically living in more affluent neighborhoods. This demographic is more likely to invest in luxury goods, including high-end jewelry. By targeting individuals with garage parking, jewelry brands can identify customers who are more inclined to make premium jewelry purchases, such as fine watches, diamond rings, or luxury accessories.

Finding the right audience for debt consolidation services

-

Challenge: A debt consolidation provider wants to reach consumers who are likely to need their services but may not be actively searching for help.

-

Unexpected solution: "Catalog Showroom credit card usage" — People who frequently use catalog showroom credit cards may have higher levels of revolving debt, often at steep interest rates. By identifying these consumers, the provider can target individuals who are likely to benefit from consolidating their debt into a lower-interest option, offering relief before they fall into deeper financial strain.

Identifying high-value clients for a financial services firm

-

Challenge: A financial services company wants to identify potential high-value clients for premium investment products.

-

Unexpected solution: "Vehicle category - luxury cars" — People who own luxury cars tend to have higher disposable income and an interest in premium goods and services. By identifying this segment, the firm can target prospects who are more likely to invest in high-end financial products, such as wealth management services, private banking, or exclusive investment opportunities.

Why AI sees what humans miss

Does all this sound a little far-fetched? Well, we don’t mean to offend you, but that might be because you’re a lowly human. The whole reason predictive AI is so valuable is its ability to recognize patterns we might never think to look for.

We rely on it because it takes care of the busy work—handling repetitive tasks far more efficiently than we ever could—but more importantly, it spots the connections we don’t. If 90% of people with Dutch gabled roofs buy BMWs, our models will detect that pattern, even if no human ever thought to check.

Faraday’s FIG does exactly this across 1,500+ datapoints, helping businesses uncover the surprising, data-backed insights that fuel real growth.

Breaking FIG down

Faraday’s Identity Graph (FIG) is what makes all of these insights possible. By synthesizing these unique attributes across hundreds of millions of U.S. adults, FIG gives businesses an unparalleled ability to understand and predict customer behavior.

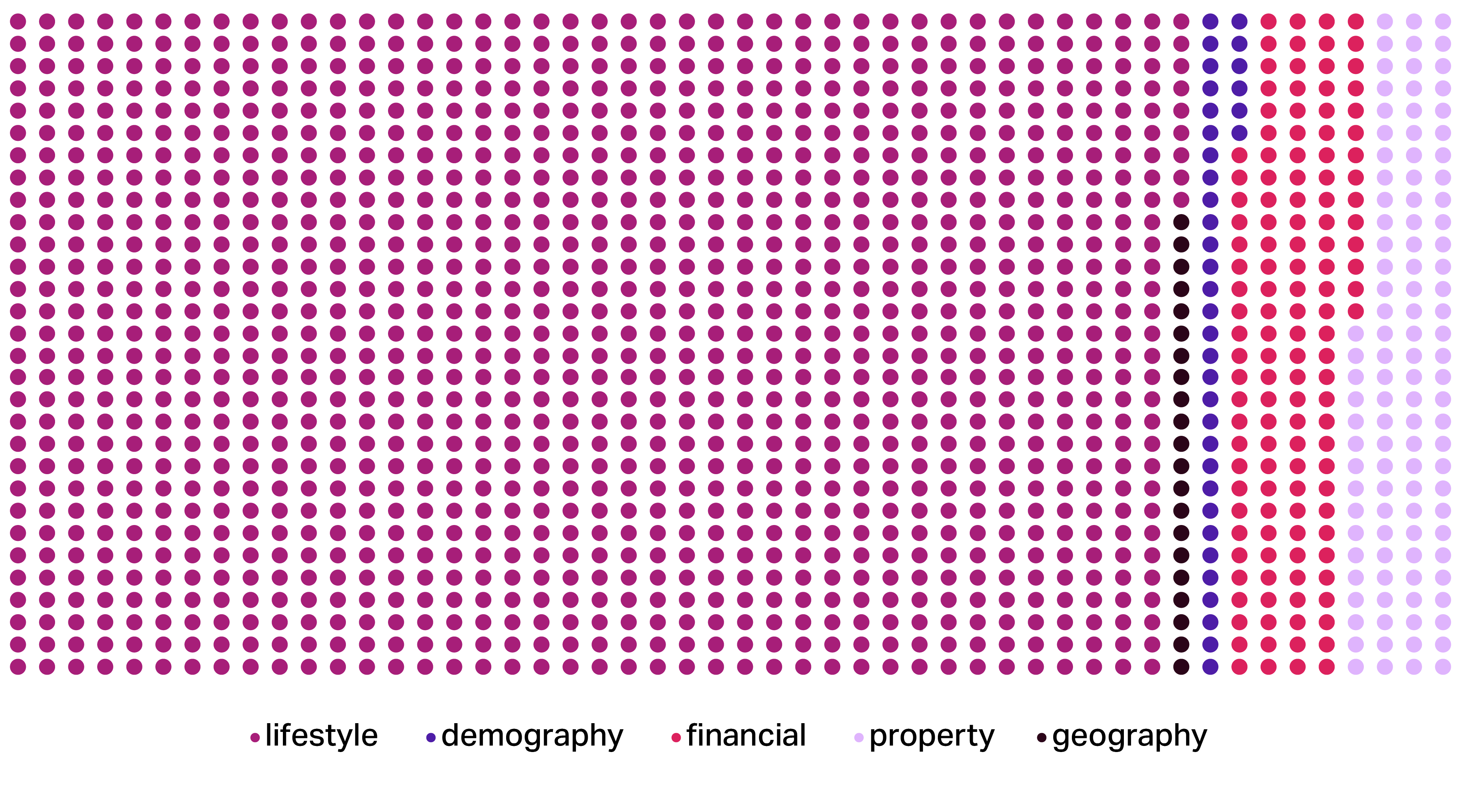

But let’s be honest—1,500 is a lot of datapoints to consider. To help make sense of it all, we’ve broken FIG down in the following graphic to show the scale of the 1,500+ attributes and also breaking them out by category. A more detailed listing of all FIG datapoints can be found and downloaded as CSV here.

FIG doesn’t just provide more data—it provides better, structured, and predictive-ready data that businesses can actually use to identify new connections that they'd likely never uncover on their own.

If you’d like to learn more about this powerful resource, take a look at the other blogs in this series!

Closing thought

Sometimes, the smallest, most unexpected datapoints unlock the biggest opportunities. FIG delivers both the obvious and the hidden predictors—helping businesses make smarter, data-driven decisions.

Want to see how these insights can transform your business? Let’s talk!

Ben Rose

Ben Rose is a Growth Marketing Manager at Faraday, where he focuses on turning the company’s work with data and consumer behavior into clear stories and the systems that support them at scale. With a diverse background ranging from Theatrical and Architectural design to Art Direction, Ben brings a unique "design-thinking" approach to growth marketing. When he isn’t optimizing workflows or writing content, he’s likely composing electronic music or hiking in the back country.

Ready for easy AI?

Skip the ML struggle and focus on your downstream application. We have built-in demographic data so you can get started with just your PII.