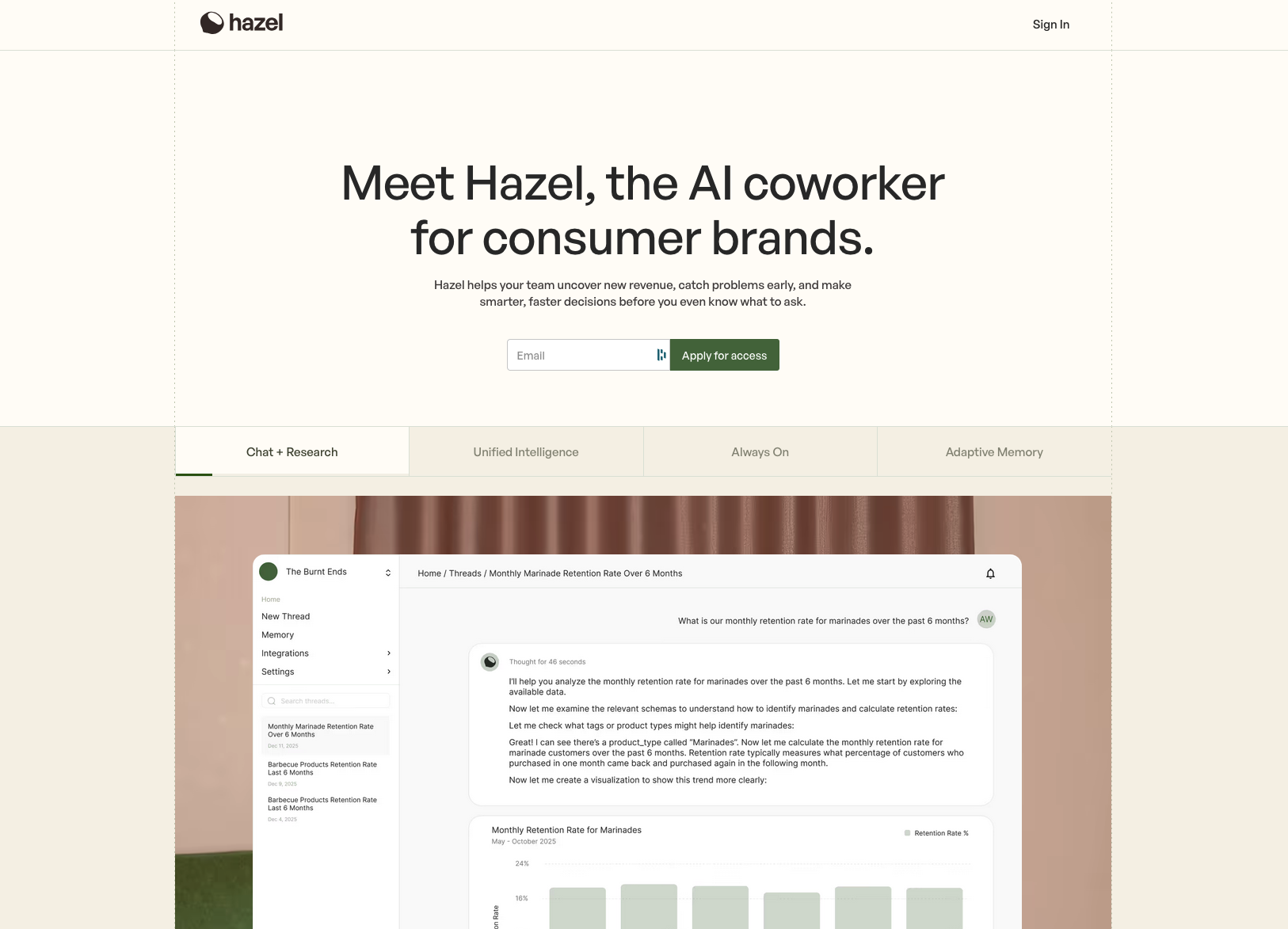

Optimizing agentic marketing with context: The story of the Hazel e-commerce assistant

Hazel is an agentic marketing platform that helps omnichannel and DTC brands make better retention and AOV decisions by triangulating first-party data, business fundamentals, and third-party consumer context. By streaming real-time consumer data from Faraday’s API, Hazel bypassed six-figure broker fees and months of engineering work, shipping a production-ready offering in weeks.

You lead customer retention at an omnichannel consumer brand and have been tasked with finding the optimal channels to engage customers to drive up repeat purchase rates.

You lead customer analytics for a fast growing DTC brand and have a KPI of increasing AOV.

In each of these instances, arriving at the optimal decision has significant revenue implications for your company. For too many marketers, though, data-informed decisions that enable optimal outcomes run headlong into real world issues like data silos, quantitative expertise, and time-to-value tradeoffs.

This is where Hazel comes in. Its platform provides an agentic AI coworker to marketers, so they can access and analyze relevant contextual data on their business, their customers, and the market in which they operate. Hazel unlocks for marketers the quantitative prowess and timely analysis needed for optimal decisioning.

Clint Dunn, Hazel’s Co-founder, talks about the triangulation of data for an optimal decision. To make an optimal decision, you need first-party customer data; you need the business-specific fundamentals like your brand’s ICP, inventory goals, and demand forecast; and you need third-party data to account for external market factors.

For Hazel to fulfill this mission, its agent must sit at the nexus of this data triangle.

Problem

For the Hazel team, solving for two parts of this triangle, access to first-party customer data and business-specific data, was largely a matter of building out integrations with their clients’ data warehouses.

For third party consumer data, Hazel’s plan was to engage with traditional data brokers like Acxiom and TransUnion. Such an approach, though, carried high risk from an ROI perspective: Hazel faced a six-figure upfront licensing fee and a multi-month engineering investment to build out:

- ETL infrastructure to process hundreds of millions of consumer records every month

- identity resolution capabilities to match first- and third-party data

- privacy compliance infrastructure for data access and deletion requests

Even with these investments made, they’d face an ongoing resource drain of updating the data, all while knowing these brokers lacked both MCP support and an off-the-shelf API for real-time contextual data retrieval. These deficiencies would seriously limit the client use cases they could support.

For a startup with limited engineering resources and working capital operating in the emerging, hyper-competitive agentic marketing vertical, this was a problematic dilemma.

Solution

With Faraday, Hazel was able to directly address these issues and reduce build-out to a matter of weeks.

Hazel gained access to the Faraday Identity Graph through Faraday’s API, giving their agent access to a high-quality source of third-party consumer data without having to take on the burden of hosting and maintaining such a dataset.

Within a day’s engineering time Hazel had a working prototype—a significant improvement over the multi-month effort they expected. Within a few weeks they arrived at a production-ready offering.

Faraday’s usage-based pricing model allowed Hazel to scale their capital investment with client uptake.

Faraday’s MCP and Lookup API ensured Hazel’s agent could retrieve data in real time and in turn support a wide range of client use cases.

Results

For Hazel, Faraday’s infrastructure dramatically accelerated its roadmap and its ability to fulfill its mission of enabling marketers to make optimal decisions. The results included:

- Upfront costs reduced from $100k+ upfront to $0 upfront; instead payments made on use.

- Initial engineering investments reduced from multi-month resourcing to a multi-week build out.

- Elimination of ongoing quarterly engineering investments to update third-party data sources.

- Automatic built-in privacy compliance infrastructure, including logical account separation.

How it works

Hazel took the following steps to implement against Faraday’s API

- Step 1: establish a Motherduck connection

- Step 2: map datasets

- Step 3: define customer and lead cohorts

- Step 4: establish data pipeline, including data appends selection for relevant context

- Step 5: deploy data back to Motherduck and make available via Lookup API for real-time retrieval

- Step 5: measure + iterate (track lift, tune thresholds).

The takeaway

In the AI age, startups like Hazel are operating in a greenfield. They are in a race to cement relationships with clients and prove out value. The opportunity cost of time correlates directly to lost market share. Finding Faraday was a major accelerant for Hazel and gave it a competitive advantage over traditional SaaS analytics and BI tools—who are, in turn, working to transform themselves into agentic platforms. For Hazel, displacing these tools and winning clients will be easier due to their agent's unique ability to triangulate the relevant data needed for optimal decisioning.

Robbie Adler

Robbie Adler is Faraday’s Chief Strategy Officer and Co-founder, leading our finance team, managing our data partnerships, and pioneering new markets for the company. Robbie’s grown multiple companies and products from infancy to maturity. He attended Middlebury College, lives in Vermont with his family, and finds joy in the outdoors and food.

Ready for easy AI?

Skip the ML struggle and focus on your downstream application. We have built-in demographic data so you can get started with just your PII.